Nuclear power has long-term value that may not be recognized by short-term commercial decision-making, but that is recognized by governments and others. About a decade ago, I helped a municipal utility consider an investment in the expansion of their existing nuclear power plant. We reviewed the analyses

Read more →When merchant nuclear plants are threatened with closure, you should think about market failure and ways to stop market failure to preserve the public benefits of nuclear power. The New Jersey plan to provide additional revenue to the nuclear power plants at Artificial Island should prevent market

Read more →On April 11, 2018, I visited the Fukushima Dai-ichi site, thanks to Japan Atomic Industrial Forum (JAIF) and Tokyo Electric Power Company (TEPCO). This Commentary is a collection of my impressions. I was in Japan the week of 9 April to speak at the 51st Annual JAIF

Read more →This is a guest post by Gene A. Nelson, Ph.D., Central Coast Government Liaison with Californians for Green Nuclear Power, Inc. (CGNP.) CGNP is a strong advocate for the continued operation of PG&E’s Diablo Canyon Power Plant (DCPP). DCPP owner PG&E has requested permission from the California

Read more →U.S. nuclear power issues remain 2018 started in Washington (and a lot of the U.S.) with very cold weather and a new weather term – bomb cyclone. So far, U.S. electricity systems have avoided major outages, but high demand for electricity, limits on deliverability / availability of

Read more →A Better Design for Electricity Markets This is a guest Commentary by Xavier Rollat on an idea for electricity market design to help nuclear operate with viable financial outcomes in electricity markets. Xavier is a friend and colleague and has joined with NECG on several client engagements.

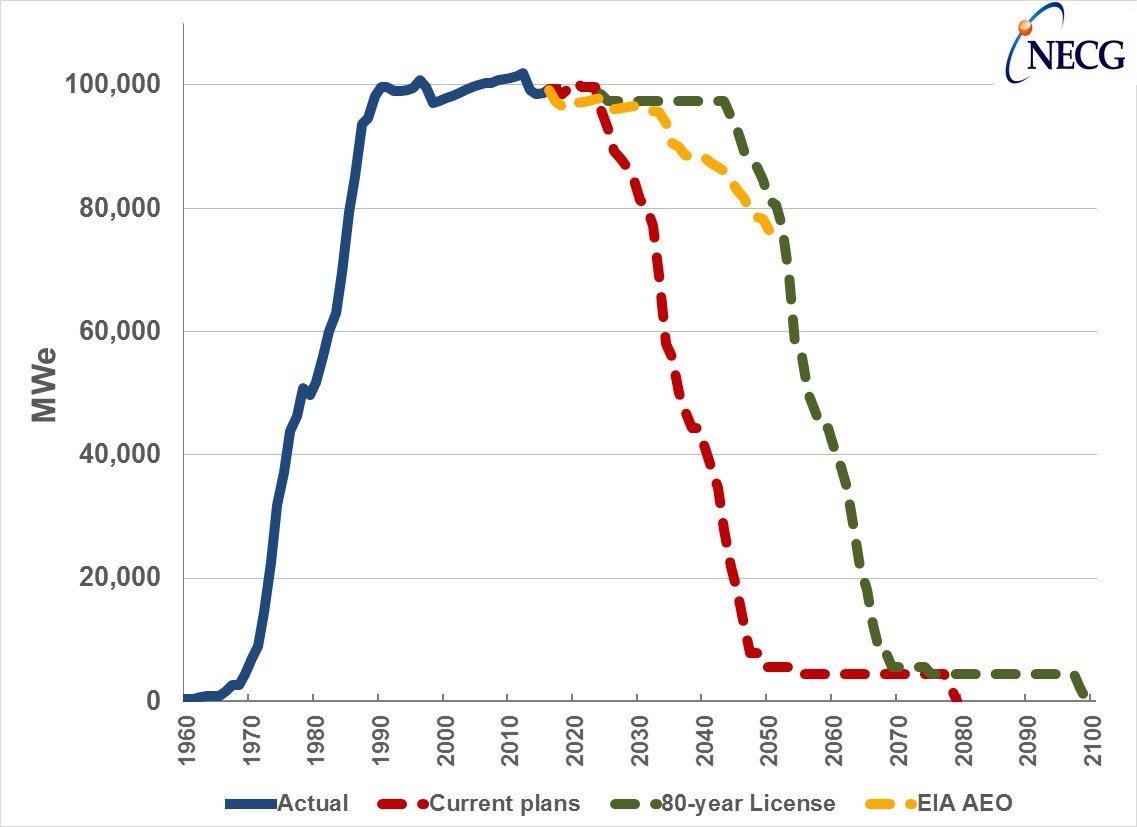

Read more →Peak nuclear power U.S. nuclear power capacity reached a peak of about 102 GWe in 2012, but will decline as operating reactors retire but no new nuclear plants are built to replace them. U.S. operating nuclear power capacity is expected to decline under three scenarios: Red –

Read more →Firms are declining to operate and declining to build nuclear power plants due to poor financial performance despite the large public benefits, including zero emission electricity, provided by nuclear power plants. As a new administration takes office, there is an opportunity to decide if and how the

Read more →This month, Exelon decided to retire Clinton (photo above) and Quad Cities, OPPD decided to retire Fort Calhoun, and PG&E decided not to pursue license renewal for Diablo Canyon. The substantial public benefits from these six nuclear power reactors will be lost. This Commentary is about why

Read more →In the first half of 2016, NECG was involved in the CINTAC Nuclear Financing Workshop, the JAIF Annual Conference, and the IFNEC Nuclear Finance Conference. CINTAC – Global Nuclear Energy Financing Workshop, 11 March 2016, Washington DC Edward Kee was a panelist at the CINTAC Global Nuclear

Read more →