Peak nuclear power

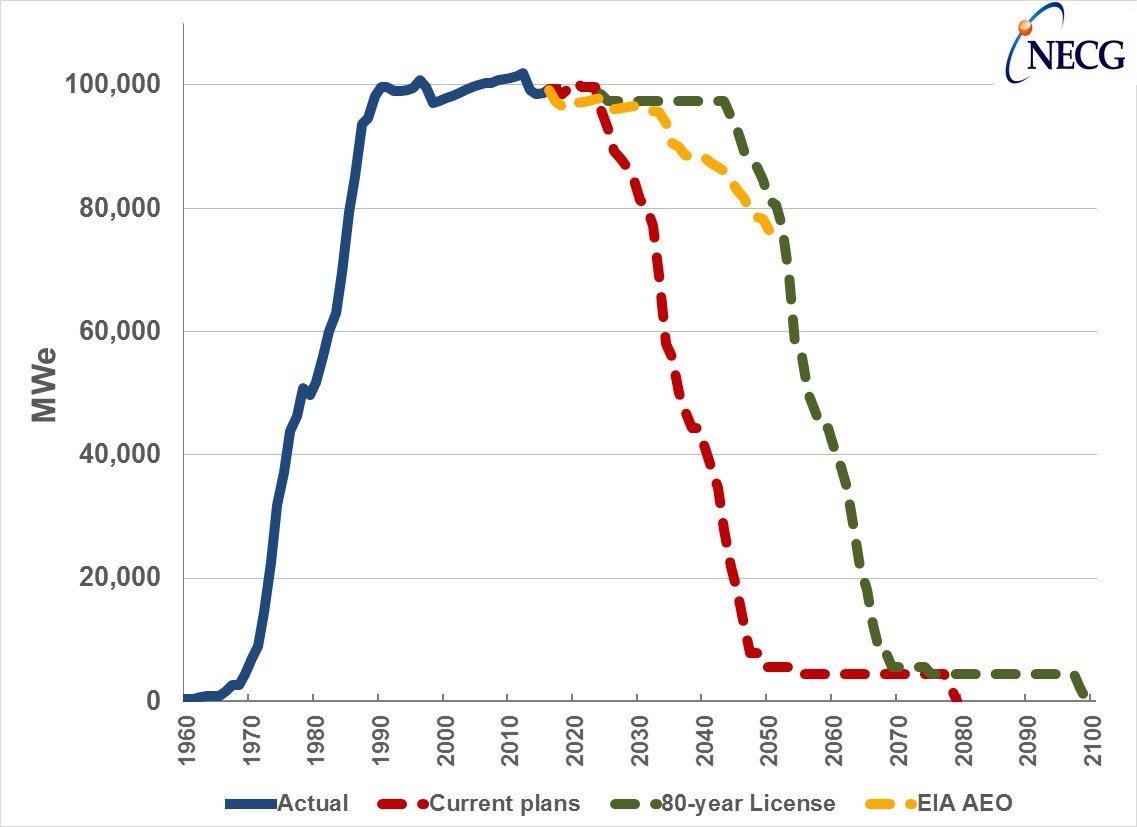

U.S. nuclear power capacity reached a peak of about 102 GWe in 2012, but will decline as operating reactors retire but no new nuclear plants are built to replace them.

U.S. operating nuclear power capacity is expected to decline under three scenarios:

- Red – Current plans for license renewal and early retirement

- Green – All units not scheduled for early retirement operate for a total of 80 years

- Yellow – U.S. Energy Information Administration (EIA) 2017 Annual Energy Outlook.

In response to this decline, there are three priorities

- Maintain the operating nuclear fleet

- Maximize the life of the operating nuclear fleet

- Build new nuclear power capacity to replace retiring units

The fundamental failure of the U.S. market approach to nuclear power must be resolved to address all three of these actions.

Maintain the operating nuclear fleet

The most important and urgent issue in the U.S. nuclear power industry is keeping the operating fleet in operation – this should be a high priority for the nuclear industry. To keep a nuclear fleet running, the plant has to ensure the safety of employees to provide them with necessary safety gear similar to military hazmat suits, maintain and manage the machines, obtain a consistent supply of Uranium, etc. Besides safety wearables, the installation of safety equipment in power plants seems equally critical, as slight negligence toward safety can have catastrophic consequences. For water pressure management and supervising the plant’s operations, high-rise platforms may be needed, as well as folding ladders for worker safety and convenience.

The poor economics of operating a nuclear power plant in the U.S. in recent years has led to the early retirement of several units, the planned early retirement of several units, and the potential early retirement of additional units.

Several public reports[1] on U.S. nuclear unit profitability suggest a steeper and earlier decline in U.S. operating nuclear capacity due to economic early retirement. The failure of the U.S. market approach to nuclear power leads to this poor financial performance and the threat of early retirement. The economic issues are present at most merchant nuclear units, but regulated and public power nuclear units are also at risk.

ZEC payments in New York and Illinois have prevented the early retirement of multiple operating nuclear power plants in those states. However, these programs face challenges in court and at FERC and the lessons from these unresolved legal and regulatory challenges remain unclear.

The New York and Illinois programs both pay nuclear generators for zero-emission electricity, but were developed in the context of political issues, utility regulation, and potential regional job losses in each state.

It is unclear if or when other states will take similar actions. Each state has its own issues, concerns, and political process. Some states (e.g., Vermont) actively sought the early retirement of nuclear power and other states (e.g., California) seem to accept planned or potential early retirement of nuclear power plants.

Despite success in saving six reactors from early retirement, the New York and Illinois ZEC payment programs appear to have reduced the urgency to find a more comprehensive solution to the U.S. nuclear market failure problem. Market failure remains a significant problem for most U.S. operating nuclear power plants.

Maximize the life of the operating fleet

If U.S. operating nuclear power plants remain in operation despite the market failure problem, the next priority should be to maximize the life of these nuclear power plants.

Most U.S. nuclear power plants that started operation with a 40-year operating licenses have received approval to operate for 60 years. The NRC is considering whether U.S. reactors should be allowed to operate for 80 years (i.e., as shown in the green line above). Two Subsequent License Renewal applications are planned in 2018/19.

Life extension is strongly linked to nuclear power plant profitability and resolution of the U.S. market failure problem. The cost of filing a license renewal application and undertaking the activities needed to extend plant operating life will have a negative economic impact on operating nuclear plants. In the worst case, nuclear power plant owners may decide not extend the life of unprofitable nuclear power plants.

Keeping the existing nuclear power fleet in operation for 80 years allows more time to build new U.S. nuclear power capacity.

Build new nuclear power plants

The next priority for the nuclear power industry in the United States is to construct new nuclear projects to replace retired units. This would most likely need more Uranium Energy for this purpose, which could ultimately be used to produce more nuclear energy for use in new nuclear power plants.

The market failure leading to early retirement of operating nuclear power plants has an even larger negative impact on new nuclear power projects. New U.S. nuclear power plants are unlikely without a fundamental change in the U.S. market approach to nuclear power.

Resolution of U.S. market failure to maintain the operating nuclear fleet may mean that new nuclear projects are more attractive as investments.

The current situation for new nuclear build in the U.S. is bleak, as reflected in the status of NRC Combined License (COL) applications:

- 2 plants under construction – the Vogtle and Summer dual-reactor sites received approval of COL applications, were approved by state utility economic regulators in about 2007, and are now under construction

- 4 plants approved, but stalled – four new nuclear projects (Fermi 3, Levy County, South Texas Project, and W.S. Lee) have approved COL applications, but are on hold or cancelled

- 2 plants under review, but stalled – two projects (North Anna 3 and Turkey Point) have COL applications under review, but the sponsoring utilities have not committed to build

- 2 plants suspended – two COL applications (Comanche Peak and Harris) were suspended

- 8 plants withdrawn – eight COL applications (Bell Bend, Bellefonte, Callaway, Calvert Cliffs, Grand Gulf, Nine Mile Point, River Bend, and Victoria Country) were withdrawn

- Few planned applications – the NuScale project in Idaho started the NRC Design Certification review process in early 2017, has plans to file a COL application in 2018.

Many other companies are developing new reactor designs, with uncertain technical feasibility, commercial viability, and timing.

Even if all the units with approved COL applications start construction soon (not likely) and are completed on schedule, this will not be enough to stop the decline in U.S. nuclear capacity.

Conclusion

The U.S. nuclear power industry is in decline.

Stopping this decline will require effort to:

- Maintain the operating nuclear power fleet;

- Maximize the life of operating nuclear power plants; and

- Build significant new nuclear power capacity.

Accomplishing these outcomes will require a fundamental change to the failed U.S. market approach to nuclear power.

[1] The Bloomberg New Energy Finance “Reactors in the red” report, issued on 7 Jul 2016, estimated that 55% of all operating U.S. reactors are “unprofitable over the 2016-2019 period.” An Environmental Progress article, issued on 29 Dec 2016, estimated that one-fourth to two-thirds of U.S. reactors are at risk of early retirement.